1.6K

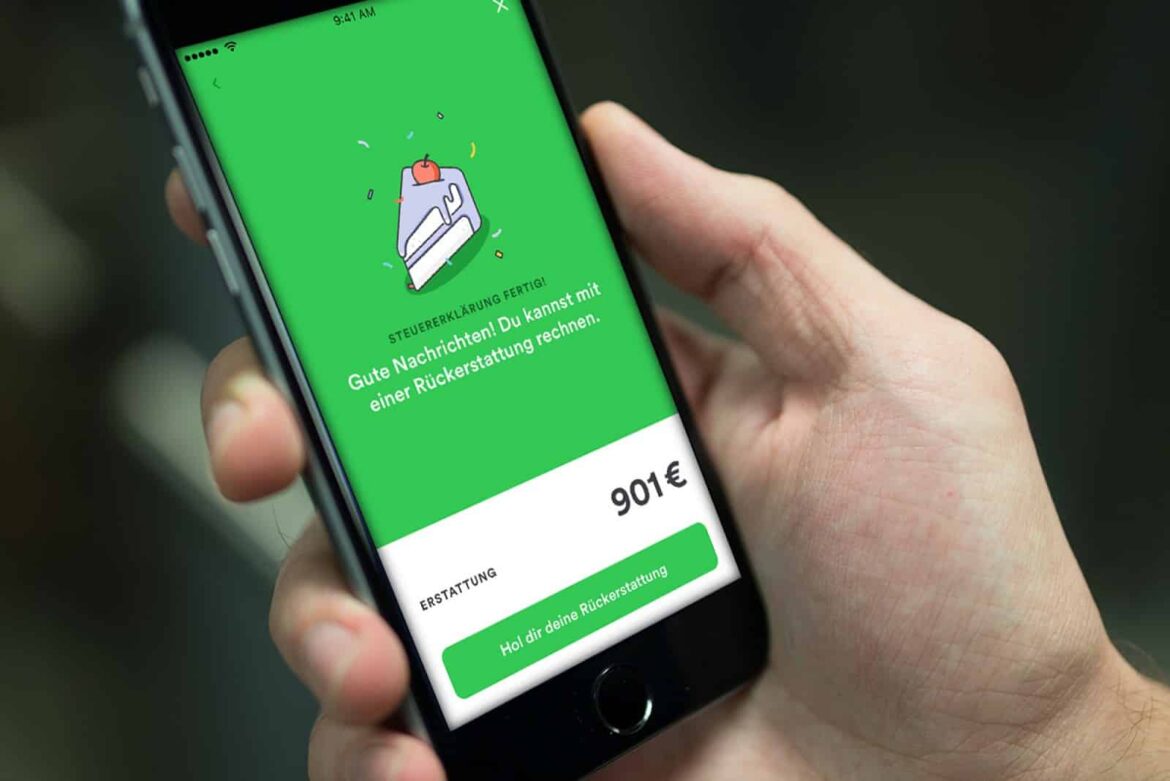

A simple app like Taxfix, which is supposed to help you do your tax return on your smartphone, may not seem quite as reputable as other programmes at first glance. Nevertheless, you can trust the provider.

Taxfix: This makes the tax app reputable

To give a short answer to the question whether Taxfix is trustworthy: Yes, the app is reputable.

- A clear sign of the app’s usefulness is that it supports ELSTER. This is the online platform where you can do all your tax office tasks without having to deal directly with the officials.

- While overly positive messages such as “tax return in just 22 minutes” and “up to 1027 euros refund” do not seem very credible, the simple language and operation of the app make exactly these promises realisable.

- Taxfix guides you from one question to the next, helping you identify and find ways to deduct certain amounts and expenses from your tax.

- In addition, customers have rated the provider relatively well so far. In the App Store, Taxfix has received 4.8 out of 5 stars from over 50,000 reviews, while on Google Play it has received 4.5 out of 5 stars from over 22,000 reviews.

- Rating platforms such as trustedshops or trustpilot also reflect a predominantly positive attitude towards the tax app and also give it over 4 out of 5 stars.

- According to your website, Taxfix is also registered in the commercial register, names three representatives, gives an address in Germany and contact details, and even lists the VAT identification number. These entries speak for rather than against seriousness, especially if one compares the commercial register number with the register portal.

- One drawback: so much support and automated advice is not always free of charge. If your information shows that you will get more than 50 euros refunded by the tax office through Taxfix, it will cost you the whole 34.99 euros. If you were to hire a professional tax advisor, however, the price would be much higher.

- Bear in mind that Taxfix has only existed since 2016 and can therefore certainly not work as perfectly as a renowned tax advisor. This is because they are not only familiar with the latest tax law changes, but also with your personal financial peculiarities.

Advantages and disadvantages of the financial programme

While the app is reputable and easy to use, it also comes with one or two pitfalls.

- Users may encounter technical problems, for example, photo scans may fail. However, in this case there is often the option to type in the data manually.

- Many problems can be solved by talking to customer service, which you can reach at [email protected] or during the week between 10 a.m. and 5 p.m. on +49 30 255 596 35.

- Since the app does not use officialese, most of the formulations are comprehensible and clear even for tax novices. In some aspects, however, there may be uncertainty, for example if it is not clear to which period or amount a question or statement refers.

- The provider promises that the data is transferred to the tax office in encrypted form. This cannot be clearly verified. However, since the programme works with ELSTER, its own servers are available and Taxfix waits for your OK before transmitting the data, it can be assumed that the app is reasonably secure.

- Taxfix offers partnerships for tax advisors. This is advantageous for private individuals because cases that are too complex for the app can be referred to these partners. While they can then charge a fee, the advisors have a shorter turnaround time due to the data you have already passed on to Taxfix.

- It can already become complex for the app if you are self-employed, have a spouse or own property.

- Companies are also to benefit from digital tax advice. In this context, employees receive additional material such as brochures, introductory videos or even the opportunity to participate in a workshop.